18 November 2020

Create Bootable Ubuntu USB Drive with Persistent Storage from Win 10

16 November 2020

Crack PDF Password using John the Ripper in Ubuntu 20.04

Scenario:

I started with PDFcrack and almost 3 days later, the program is still running !!!. So that's when I started looking at alternatives. Nothing wrong with PDFcrack per se, just that it is one of the limitations of brute force password cracking. In fact there is even a beautiful blogpost from Ruby Pdf Technologies on some of the intricacies of PDFcrack.

I remembered using something earlier when I was experimenting with Kali Linux. So I went back to the "gold standard" which is called John the Ripper password cracker.

Types of Password's:

14 November 2020

Install Nvidia Drivers & CUDA in Ubuntu 20.04 (in UEFI mode with Secure Boot Enabled)

In the previous article, we have dealt with Installation of Ubuntu in Dual Boot Mode using UEFI. Now lets look at the installation of Nvidia Drivers for the GPU.

Basic Verification's:

First let us find out the graphics card that is presently used by the system. Click on Settings->About. Presently we have "NV138 / Mesa Intel® UHD Graphics 620 (KBL GT2)" installed.

09 November 2020

Dual Boot Win 10 and Ubuntu for system with (SSD + HDD) using UEFI - GPT method

Scenario:

I intend to use a Linux based VPS to host my trading strategies on AWS. So how do I create a dual boot in my existing Win 10 machine ?

22 September 2020

Thread Synchronization using Event Object in Python - Interactive Brokers Part 4

- This is sometimes achieved by using a "trial and error approach using the time.sleep() function in Python". While this may work, it is always a problematic issue in determining the amount of time we need to wait. And using the time.sleep() in such cases is not the right way of achieving the result.

- Another approach is to use flags to arrive at a better approximation in using the time.sleep() function.

- Use the Event Object to achieve thread synchronization

07 September 2020

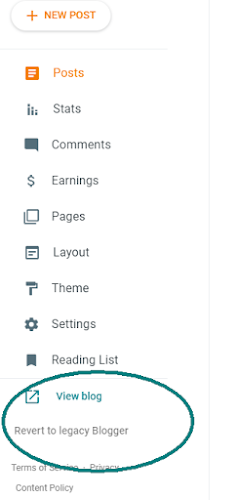

Making blogger a little less painful

Table of Contents

Recently google made an update to blogger for formatting code and inserting anchors in the Compose View itself(instead of HTML view). Yeah, it was just about the time when they came out with this fine separation between "blogger" and "legacy blogger".

The new changes they had incorporated was very good, focused as it was on simplicity . I actually used it to create one blog post which required the use of Table of Contents right from the "Compose View". I also used it to insert my Python code right from the "Compose View". Imagine the savings in time for somebody who makes a blog post daily ?

Suddenly a few days later all of it vanished as mysteriously as they appeared. Another Google+ ??? (oh yeah, that much touted alternative to Facebook)

Google seems to have done a veto on their recent updates to blogger. But yet I prefer google over some other blogging options like Medium becos in the near future google corporation don't need to worry about monetizing blogger , unlike the corporation run by Evan William's. ( He is the same guy who started blogger too , which was latter purchased by Google ).

So I began to think - How can I make blogging more easy on blogger instead of switching to another platform. Maybe google might bring those feature back, or maybe they wont. We don't know. So lets see what we can do for now.

I would like to cover the following issues which are of concern to me:

Formatting Source Code:

10 August 2020

Advanced Techniques in TWS API - Interactive Brokers Part 3

In the first part of the blog on the TWS API of Interactive Brokers, I have dealt with the Installation of TWS API on a Windows machine for Anaconda distro.

In the second part of the blog, titled Fundamentals of TWS API, I have dealt with the essentials to get started.

Now in this third part I seek to explore the concepts like using a scanner, retrieving the OHLCV data and writing it to a CSV file, Hedging a Futures Contract with Options and many others including a fully functional sample trading system.

Table of Contents :

Optionable Contracts in NSE using the Scanner

Let's get to the point straight - The TWS API is just an interface to the TWS. If you are having problems defining a scanner viz the API , always make sure you can create a similar scanner using the TWS or the Mosaic Market Scanner.

24 June 2020

Fundamentals of TWS API - Interactive Brokers Part 2

Generally Interactive Brokers releases the installer for both the TWS API and IB Gateway simultaneously. For this blog I will use TWS API ( Version: API 9.79 Release Date: Feb 05 2020 ) and not IB Gateway. Check out my previous blog post for detailed installation guide of TWS API on Win 10 Machine that uses the Anaconda Distribution for Python.

IB also has a host of API's. A recent one that they added is a REST based API which they refer to as Client Portal WebAPI . However this blog post deals solely with the TWS API

Table of Contents :

The general operation of the TWS API application is:

- Establish connection with IB server.

- Request information from IB server or execute an action

- If a response is provided by the IB server, then receive the response and process the response

- Repeat steps 2 & 3 until all the required information has been received and all the operations have been executed.

- Terminate the Connection with IB server.

30 April 2020

Installation of TWS API - Interactive Brokers Part 1

- Automate your strategies

- Create a custom trading terminal

- Develop a Screener

- Experiment with your own Trading Indicator

And besides the TWS API, there are also other API solutions that are offered by Interactive Brokers and check them in this PDF download. Also one can check out groups for discussion on API

15 April 2020

Calculation of Supertrend (ST)

In its simplest form, when the Supertrend is overlayed over a candlestick chart, if the Supertrend crosses to below the Price we take a Long Position and when the Supertrend crosses to above the Price, we take a Short position. Here is a snapshot of the Supertrend.

This article from Economic Times is probably a good place to start with to get a qucik overview of Supertrend.

So let us dive straight into and get the calculation of Supertrend. Check this Google Sheet for the Calculation of Supertrend.

Given below is the pseudo code for the calculation of Supertrend:

Basic UpperrBand = (High + Low) / 2 + Multiplier * ATR

Basic LowerBand = (High + Low) / 2 - Multiplier * ATR

Final UpperBand = IF((Current BasicUpperband < Previous Final UpperBand) OR

(Previous Close > Previous Final UpperBand)) THEN

(Current Basic UpperBand) ELSE

(Previous FinalUpperBand)

Final LowerBand = IF((Current Basic LowerBand > Previous Final LowerBand) OR

(Previous Close < Previous Final LowerBand)) THEN

(Current Basic LowerBand) ELSE

(Previous Final LowerBand)

SuperTrend = IF((Previous SuperTrend = Previous Final UpperBand) AND

(Current Close <= Current Final UpperBand)) THEN

Current Final UpperBand

ELSE

IF((Previous SuperTrend = Previous Final UpperBand) AND

(Current Close > Current Final UpperBand)) THEN

Current Final LowerBand

ELSE

IF((Previous SuperTrend = Previous Final LowerBand) AND

(Current Close >= Current Final LowerBand)) THEN

Current Final LowerBand

ELSE

IF((Previous SuperTrend = Previous Final LowerBand) AND

(Current Close < Current Final LowerBand)) THEN

Current Final UpperBand

Now lets see how this is calculated in Python. Lets first download the OHLCV data from the above google sheet into a CSV file. Name it as "test data". We can use this as our input file for the Python program.

Lets first take a look at the Imports and Global Declarations that we will use in this program:

#imports used in the program import numpy as np import pandas as pd #Global Declarations input_file = "test data.csv" multiplier = 2 # An integer to indicate the value to multiply the ATR. period = 14 atr = 'ATR' + '_' + str(period) st = 'SuperTrend' + '_' + str(period) + '_' + str(multiplier)