Generally Interactive Brokers releases the installer for both the TWS API and IB Gateway simultaneously. For this blog I will use TWS API ( Version: API 9.79 Release Date: Feb 05 2020 ) and not IB Gateway. Check out my previous blog post for detailed installation guide of TWS API on Win 10 Machine that uses the Anaconda Distribution for Python.

IB also has a host of API's. A recent one that they added is a REST based API which they refer to as Client Portal WebAPI . However this blog post deals solely with the TWS API

Table of Contents :

The general operation of the TWS API application is:

- Establish connection with IB server.

- Request information from IB server or execute an action

- If a response is provided by the IB server, then receive the response and process the response

- Repeat steps 2 & 3 until all the required information has been received and all the operations have been executed.

- Terminate the Connection with IB server.

From the developer's perspective, this is the communication process:

- Connect to TWS API by creating a socket

- Send requests (messages) to TWS API through the socket

- Receive responses (messages) from the TWS API through the socket.

A physical electrical socket in our house is an entry point for a power cable. A software socket is also an entry point, but instead of accepting a power cable, it accepts a network connection from another computer. IP addresses, ports, and TCP/IP are the related technologies that made sockets possible. To give a simplistic explanation, a socket is the combination of an IP addrress and a port. So when an application sends a socket based request to a specific IP address and port number, the receiving application can reply with a response. Communicating with TWS uses this approach.

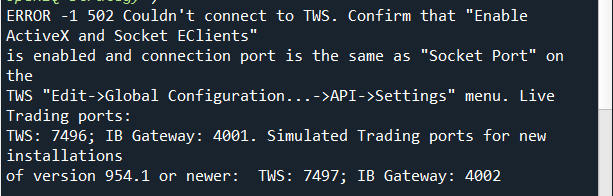

If a Python application sends a message to the IP address of a system running TWS API and sets the port number to 7497 (for paper trading in IB gateway, port number is set to 4002), then TWS will send the message to one of IB' servers which will send an appropriate response to TWS API that is sent back to the Python application. This process is explained in the diagram below:

Each Arrow in the above process represents a step in the socket communication process:

- The Application (Client) send a message(request) to the IP address of the system running TWS API.

- The TWS API receives the message, authenticates it and sends another message to the IB server

- The IB server receives the message , processes it and sends a message to the TWS API

- TWS API forwards the message (response) to the application

As developers we are only concerned with the Step 1 and Step 4. So we write an application that send requests to the TWS API and receives responses.

In Win 10 path C:\TWS API if you open the TWS API directory, you will find a folder named "source". This contains a sub-directory named "pythonclient". This has two sub-directories named "ibapi" and "tests". The "ibapi" folder contains source files for the Python API. Among the programs are client.py and wrapper.py

And when you run a Python application, you will have to set the sys.path or PYTHONPATH variable to the location of ibapi. If you have configured the path correctly, you will be able to import classes using the following import statements:

from ibapi.client import EClient from ibapi.wrapper import EWrapperSchematically any Python program that we will write to use the IB API will have two main classes and it is illustrated below:

The wrapper.py module defines the EWrapper class which contains more than 100 methods. And if you peruse them , you will find that most of them merely write a message to the log.

To understand how these functions can be used, consider the following code, which prints the argument received by the currentTime method:

def currentTime(self, curr_time):

t = datetime.fromtimestamp(curr_time)

print('Current time: {}'.format(t))

Now if the client calls reqCurrentTime and the response is stored in the message queue, the decoder will access the clients wrappper and call currentTime function. These response methods of the EWrapper class are called callbacks.

from ibapi.utils import iswrapper

@iswrapper

def historicalData(self, reqId, bar):

''' Callback to reqHistoricalData '''

print('\nOpen: {}, High: {}, Low: {}, Close: {}'.format(bar.open, bar.high, bar.low, bar.close))

@iswrapper

def error(self, reqId, code, msg):

print('Error {}: {}'.format(code, msg))

# Establish a Connection with IB APi

from ibapi.client import EClient

from ibapi.wrapper import EWrapper

import time

class TestAPI(EWrapper, EClient):

def __init__(self):

EClient.__init__(self, self)

client = TestAPI()

client.connect('127.0.0.1', 7497, 123)

client.run()

client.connect(host, port, clientId)

In the Python Script above, 127.0. 0.1 is the loopback Internet protocol (IP) address also referred to as the localhost. The address is used to establish an IP connection to the same machine or computer being used by the end-user.

The client.run() command reads message from the queue and executes everything. It executes in a loop that repeats as long as the client is connected. For this reason, applications frequently execute the clients run function in a separate thread using code like shown below:

thread = Thread(target=self.run) thread.start()

After running the above Python script, you would have noticed that the IPython terminal of the Spyder IDE (that comes with anaconda distribution) continues to be active. That’s becos the connection is still open and we have not run the app.disconnect() command.

With Interactive Brokers, a connection is first made to the IB Client software which acts as an intermediary to the IB servers. This requires an Open and Constant connection and that is one of the reason why we use separate threads to handle incoming messages (EWrapper) and outgoing messages (EClient).

This presents a challenge when we are using interactive IDE like Spyder or Jupyter Notebooks. The EClient functions (outgoing calls) tend to work fine but EWrapper functions (incoming data) present issues due to the lack of an open connection. There is a workaround for this in case you want to use interactive IDE like Spyder - Use IB-insync library which uses the asyncio library to provide an asynchronous single thread to interact with the API. In case you want to post queries or get clarifications, check out the discussions in the Group for the IB-insync Python framework

Some other popular IDE/Code Editor to consider include VSCode, Sublime Text, PyCharm, Atom etc., I prefer VSCode and you can check out the VSCode tutorials in case you want to experiment with it. Check them and use the one that suits you.

We know that applications communicate with IB through sockets. An application writes data to the socket and reads data from the socket. Packages of received data are called messages. And applications store messages in a first-in first-out (FIFO) data structure called message queue.

Applications cannot control when new data will be available. So they create a separate execution thread to read from the socket and write to the message queue. For this reason most applications perform their processing in two threads:

- Client Thread - Send data to socket, Read messages from the queue.

- Reader Thread - Read data from Socket , Write messages to the queue.

Generally these threads work in the following manner:

- The application starts the client thread, which send requests to the TWS API.

- The client thread goes to sleep while TWS API transfers data to its socket.

- When the client thread is asleep, the reader thread reads data from the socket and writes a message to the message queue.

- As messages enter the queue, a decoder processes each of them and invokes corresponding call back function of the clients wrapper.

As a developer, we will probably never write any Python code that interacts directly with the reader thread, message queue or the decoder. However as you develop applications, you will find it helpful to understand how a clients requests results in wrapper functions being invoked.

Essentially a contract is a Financial Instrument. Anything that is available for trading in IB like Stocks, futures and options, bonds, IB special products like Contract For Difference(CFD), etc., is called a Contract. An Order is used to buy and sell a Contract.

In TWS API , the contracts are represented by instances of the Contract structure as described in the contract.py file in the directory C:\TWS API\source\pythonclient\ibapi

If you open the TWS terminal and right click on a symbol in the market watch and check Financial Instrument Info -> Description , then you will get all details on that symbol. A typical Python code will look like this:

#Create contract object contract = Contract() contract.symbol = 'INFY' contract.secType = 'STK' contract.exchange = 'SMART' contract.currency = 'INR' contract.primaryExchange = "NSE"

The first four fields are the fundamental fields. The field secType with value STK refers to stock and the currency is set to Indian Rupees (INR). IB provides a service called SMART routing wherein the router searches exchanges and directs orders to the best exchange for a given contract. However since a stock like INFY is traded both in NSE and BSE stock exchange, it is preferable to mention primaryExchange to ensure that there is no ambiguity (who knows, IB might start trading in BSE also in the future!!!. )

In case you want more details about any given financial instrument programmatically, you can use the reqContractDetails method. After TWS API receives the request, the python application will receive the response through the contractDetails callback function. If you can't remember a contract's symbol, you can request possible symbols by calling the client's reqMatchingSymbols method. After an application calls reqMatchingSymbols it can obtain the server's response through the symbolSamples callback function. The point to note is that every function has a necessary callback (in some cases more than one callback) and in the corresponding callback, we can retrieve the information we seek.

Lets check out a python program to read a Contract:

# Imports for the Program

from ibapi.client import EClient

from ibapi.wrapper import EWrapper

from ibapi.contract import Contract

from ibapi.utils import iswrapper

import time

import threading

class TestContract(EWrapper, EClient):

''' Serves as the Client and the Wrapper '''

def __init__(self, addr, port, client_id):

EWrapper.__init__(self)

EClient.__init__(self, self)

# Connect to TWS API

self.connect(addr, port, client_id)

# Launch the client thread

thread = threading.Thread(target=self.run)

thread.start()

@iswrapper

def symbolSamples(self, reqId, contractDescriptions):

# Print the symbols in the returned results

print ('...')

print('Number of Contract descriptions in List: {}'.format(len(contractDescriptions)))

for contractDescription in contractDescriptions:

print('Symbol: {}'.format(contractDescription.contract.symbol))

print('Contract ID: {}'.format(contractDescription.contract.conId))

print('Contract Security Type: {}'.format(contractDescription.contract.secType))

print('Contract Primary Exchange: {}'.format(contractDescription.contract.primaryExchange))

print('Contract Currency: {}'.format(contractDescription.contract.currency))

# Select the first symbol

self.symbol = contractDescriptions[0].contract.symbol

@iswrapper

def contractDetails(self, reqId, details):

print('\nDetails of first symbol follows:')

print('Market Name: {}'.format(details.marketName))

print('Long Name: {}'.format(details.longName))

print('Industry Classification: {}'.format(details.industry))

print('Industry Category: {}'.format(details.category))

print('Subcategory: {}'.format(details.subcategory))

print('Contract ID: {}'.format(details.contract.conId))

print('Time Zone for the Product: {}'.format(details.timeZoneId))

print('Trading Hours of the Product: {}'.format(details.tradingHours))

print('\nFull Contract Details, Unformatted:', reqId, " ", details)

@iswrapper

def contractDetailsEnd(self, reqId):

print ('...The End of Contract Details...for reqId:{} '.format(reqId))

def error(self, reqId, code, msg):

print('Error Code: {}'.format(code))

print('Error Message: {}'.format(msg))

def main():

# Create the client and connect to TWS API

client = TestContract('127.0.0.1', 7497, 700)

time.sleep(3)

# Request descriptions of contract starting with "goog"

client.reqMatchingSymbols(0, 'goog')

time.sleep(3)

# Request details for the Stock

contract = Contract ()

contract.symbol = client.symbol

contract.secType = "STK"

contract.exchange = "SMART"

contract.currency = "USD"

client.reqContractDetails(1, contract)

time.sleep(3)

client.disconnect()

if __name__ == "__main__":

main()

Now replace "goog" with "TCS" in the above program and check out the details of the symbol. !!! That's why it is important to explicitly set the contract.primaryExchange field as NSE in case you are operating in the Indian markets.

In TWS API , the orders are represented by instances of the Order structure as described in the order.py file in the directory C:\TWS API\source\pythonclient\ibapi . To execute Orders programmatically, this is typically how a code would look:

order = Order() order.action = "BUY" order.totalQuantity = 100 order.orderType = "MKT"

Besides the plain vanilla MKT orders, there is another variant which is of interest to me. Particularly becos many of my strategies use Stop Loss Orders (Stop Order) along with Target Price which I code manually . This is the Order Type MIT (Market if Touched). Here we also have to set the auxillary price which is essentially the Trigger Price.

order = Order() # Set the order's type to Market if Touched (MIT) order.orderType = "MIT" # Set the trigger price to 90 order.auxPrice = 90

Although Market Orders are the easiest to place, particularly when we want a fill for sure, it is always problematic for an illiquid contract where the Bid-Ask spreads are high. That's where the Limit Order becomes helpful. As an example, if we place a Buy order at a Limit Price of 100, then IB will execute the order at any price Less than or equal to 100. We need to set order.orderType = "LMT" to place a limit order.

Another variant of the limit order is Limit if Touched (LIT)

order = Order() # Set the order's type to Limit if Touched (LIT) order.orderType = "LIT" # Set the limit price to 90 order.lmtPrice = 90 # Set the trigger price to 110 order.auxPrice = 110

order = Order() # Set the order's type to Stop Order (STP) order.orderType = "STP" # Set the trigger price to 90 order.auxPrice = 90

order = Order() # Set the order's type to Trailing. order.orderType = "TRAIL" # Set the trailing Stop Price to 80 order.trailStopPrice = 80 # Set the trailing percentage to 5 order.trailingPercent = 5

placeOrder(orderId, contract, order)

openOrder (orderId, contract, order, orderState)

orderStatus(orderId: OrderId, status: str, filled: float, remaining: float, avgFillPrice: float, permId: int, parentId: int, lastFillPrice: float, clientId: int, whyHeld: str, mktCapPrice: float):

The status argument tells the application what has happened to the order. This can take one of the values mentioned below:

- PendingSubmit: Order transmitted but not accepted

- PendingCancel: Order cancellation request sent but not confirmed

- PreSubmitted: Simulated order accepted but not submitted

- Submitted: Order accepted by IB

- ApiCanceled: Order cancellation requested by API client but not confirmed

- Canceled:Order canceled

- Filled: Order completely filled

- Inactive: Order received but not active because of rejection or cancellation

If the order is filled, the filled argument identifies the number of filled positions. If the order is only partially filled, then the remaining argument gives the number of positions that were not filled. The avgFillPrice argument gives the average price at which the order was placed. permId is used by TWS and orderId is the Id of the order whose status is being provided. parentId is the Id of the orders parent and clientId is the Id of the API client that submitted the order.

Generally in TWS API, there is a one-to-one relationship between a request function and its corresponding callback function. However in the case of Orders, the relationship is many-to-many: many request functions have multiple callback's and some callback's are invoked in response to multiple request functions.

|

Request Functions |

Corresponding Callback's |

Notes |

|

reqOpenOrders()

reqAllOpenOrders()

reqAutoOpenOrders(True) |

openOrder(orderId, contract, order, orderState)

orderStatus(orderId, status, filled, remaining, avgFillPrice, permId, parentId, lastFillPrice, clientId, whyHeld, mktCapPrice) |

If an application calls reqOpenOrders , it will only receive data about the orders submitted by the client that called reqOpenOrders. However if an application calls reqAllOpenOrders, it will receive the state of all open orders for each client transmitting orders to the target TWS.

Active orders will be delivered via The openOrder callback and The orderStatus callback. When all orders have been sent to the client application you will receive a IBApi.EWrapper.openOrderEnd event:

reqAutoOpenOrders requests status of future orders placed by TWS. This is only available for the master client (Client 0). If its argument is set to true, future orders will be assigned IDs associated with the client calling reqAutoOpenOrders |

|

reqExecutions(reqId, ExecutionFilter()) |

execDetails(reqId, contract, execution)

execDetails(reqId, contract, execution): |

After an application calls reqExecutions , two callback functions are invoked in response: execDetails and commissionReport . execDetails contains information about the executed order and commissionReport identifies the order's commission, profit, loss, and yield.

The reqExecutions function requests information about orders that were successfully executed since midnight. This accepts an ExecutionFilter that identifies which executed orders should be identified.

execDetails is invoked once for every order executed in the last 24 hours that meet the criteria set by the ExecutionFilter |

# Imports for the Program

from ibapi.client import EClient

from ibapi.wrapper import EWrapper

from ibapi.contract import Contract

from ibapi.order import Order

from ibapi.utils import iswrapper

import time

import threading

import sys

class TestLimitOrder(EWrapper, EClient):

''' Serves as the Client and the Wrapper '''

def __init__(self, addr, port, client_id):

EWrapper.__init__(self)

EClient.__init__(self, self)

self.orderId = None

# Connect to TWS API

self.connect(addr, port, client_id)

# Launch the client thread

thread = threading.Thread(target=self.run)

thread.start()

@iswrapper

def nextValidId(self, orderId):

''' Provides the next order ID '''

self.orderId = orderId

print('\nThe order id is: {}'.format(orderId))

@iswrapper

def openOrder(self, orderId, contract, order, state):

''' Callback for the submitted order '''

print('Order Status: {}'.format(state.status))

print('The accounts current initail margin: {}'.format(state.initMarginBefore))

print('The accounts current maintanence margin: {}'.format(state.maintMarginBefore))

print('Comission Charged: {}'.format(state.commission))

print('Completed Time: {}'.format(state.completedTime))

print('Warning Text: {}'.format(state.warningText))

@iswrapper

def orderStatus(self, orderId, status, filled, remaining, avgFillPrice, permId, parentId, lastFillPrice, clientId, whyHeld, mktCapPrice):

''' Check the status of the submitted order '''

print('Status of Order: {}'.format(status))

print('No. of Filled Positions: {}'.format(filled))

print('No. of remaining positions: {}'.format(remaining))

print('Why Held: {}'.format(whyHeld)) # value 'locate'used when trying to locate shares for short sell

print('Average Fill Price: {}'.format(avgFillPrice))

print('permId: {}'.format(permId))

@iswrapper

def position(self, account, contract, pos, avgCost):

''' Provides the portfolios Open Positions'''

print('No. of Positions held in {} : {} '.format(contract.symbol, pos))

print('The average cost of the position: {}'.format(avgCost))

@iswrapper

def accountSummary(self, reqId, account, tag, value, currency):

'''Read Information about the Account'''

print('Account {} : {} = {}'.format(account, tag, value))

print('The currency on which the Value is expressed: {}'.format(currency))

@iswrapper

def error(self, reqId, code, msg):

print('Error Code: {}'.format(code))

print('Error Message: {}'.format(msg))

def main():

# Create the client and Connect to TWS API

client = TestLimitOrder('127.0.0.1', 7497, 7)

time.sleep(3)

client.orderId = None

# Define a Contract

contract = Contract()

contract.symbol = 'SBIN'

contract.secType = 'STK'

contract.exchange = 'SMART'

contract.currency = 'INR'

contract.primaryExchange = "NSE"

# Define the Limit Order for BUY/SELL

order = Order()

order.action = 'BUY'

order.totalQuantity = 42

order.orderType = 'LMT'

order.lmtPrice = '10.2' # Place the limit order far off from the actaul market price. For Test

#order.transmit = False # when set to false, the order wont actually be executed when the program is run

# Request from TWS, the next valid ID for the order

client.reqIds(1)

time.sleep(3)

# Place the order

if client.orderId:

client.placeOrder(client.orderId, contract, order)

time.sleep(3)

else:

print ('Order ID not received. Terminating Application')

sys.exit()

# Obtain information about open positions

client.reqPositions()

time.sleep(3)

# Obtain information about Account

client.reqAccountSummary(7, 'All', 'AccountType')

time.sleep(3)

# Cancel Order

print ('Cancelling the Order')

client.cancelOrder(client.orderId) # Cancel the above order which has been placed

# Disconnect from TWS

time.sleep(3)

client.disconnect()

if __name__ == "__main__":

main()

In the above program, the main function calls reqIds to obtain a valid ID for the next order. When the ID becomes available, main calls placeOrder with the Contract structure, Order structure, and ID. As a result of the placeOrder call, two callbacks are invoked. The first is openOrder, and the second is orderStatus. After submitting the order, main calls reqPositions to request information related to the account's open positions and reqAccountSummary to request information related to the account. The application accesses the requested data through the position callback and accountSummary callbacks. Lastly the order is cancelled with cancelOrder before disconnecting from TWS.Now let us take a look at a program to implement a Bracket Order, which is essentially an order that is placed simultaneously with a Stop Loss and/or a Target (take profit). When we place such an order, if the Target is hit, then the entire order stands "executed" , in the sense that the Stop Loss is automatically cancelled.

Bracket Orders are designed to help limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. A BUY order is bracketed by a high-side sell limit order and a low-side sell stop order. A SELL order is bracketed by a high-side buy stop order and a low side buy limit order. Note how bracket orders make use of the TWS API's Attaching Orders mechanism.

Advanced orders such as Bracket Orders or Hedging involve attaching child orders to a parent. This can be easily done via the IBApi.Order.ParentId attribute by assigning a child order's IBApi.Order.ParentId to an existing order's IBApi.Order.OrderId. When an order is attached to another, the system will keep the child order 'on hold' until its parent fills. Once the parent order is completely filled, its children will automatically become active.

One key thing to keep in mind is to handle the order transmission accurately. Since a Bracket consists of three orders, there is always a risk that at least one of the orders gets filled before the entire bracket is sent. To avoid it, make use of the IBApi.Order.Transmit flag. When this flag is set to 'False', the TWS will receive the order but it will not send (transmit) it to the servers. In the example below, the first (parent) and second (takeProfit) orders will be send to the TWS but not transmitted to the servers. When the last child order (stopLoss) is sent however and given that its IBApi.Order.Transmit flag is set to true, the TWS will interpret this as a signal to transmit not only its parent order but also the rest of siblings, removing the risks of an accidental execution.

# Imports for the Program

from ibapi.client import EClient

from ibapi.wrapper import EWrapper

from ibapi.contract import Contract

from ibapi.order import Order

from ibapi.utils import iswrapper

import time

import threading

import sys

class TestBracketOrder(EWrapper, EClient):

''' Serves as the Client and the Wrapper '''

def __init__(self, addr, port, client_id):

EWrapper.__init__(self)

EClient.__init__(self, self)

self.orderId = None

# Connect to TWS API

self.connect(addr, port, client_id)

# Launch the client thread

thread = threading.Thread(target=self.run)

thread.start()

@iswrapper

def nextValidId(self, orderId):

''' Provides the next order ID '''

self.orderId = orderId

print('\nThe order id is: {}'.format(orderId))

@iswrapper

def openOrder(self, orderId, contract, order, state):

''' Callback for the submitted order '''

print('Order Status: {}'.format(state.status))

print('The accounts current initail margin: {}'.format(state.initMarginBefore))

print('The accounts current maintanence margin: {}'.format(state.maintMarginBefore))

print('Comission Charged: {}'.format(state.commission))

print('Completed Time: {}'.format(state.completedTime))

print('Warning Text: {}'.format(state.warningText))

@iswrapper

def orderStatus(self, orderId, status, filled, remaining, avgFillPrice, permId, parentId, lastFillPrice, clientId, whyHeld, mktCapPrice):

''' Check the status of the submitted order '''

print('Status of Order: {}'.format(status))

print('No. of Filled Positions: {}'.format(filled))

print('No. of remaining positions: {}'.format(remaining))

print('Why Held: {}'.format(whyHeld)) # value 'locate'used when trying to locate shares for short sell

print('Average Fill Price: {}'.format(avgFillPrice))

print('permId: {}'.format(permId))

@iswrapper

def position(self, account, contract, pos, avgCost):

''' Provides the portfolios Open Positions'''

print('No. of Positions held in {} : {} '.format(contract.symbol, pos))

print('The average cost of the position: {}'.format(avgCost))

@iswrapper

def accountSummary(self, reqId, account, tag, value, currency):

'''Read Information about the Account'''

print('Account {} : {} = {}'.format(account, tag, value))

print('The currency on which the Value is expressed: {}'.format(currency))

@iswrapper

def error(self, reqId, code, msg):

print('Error Code: {}'.format(code))

print('Error Message: {}'.format(msg))

@iswrapper

def execDetails(self, req_id, contract, execution):

print('Order Executed: ', req_id, contract.symbol, contract.secType, contract.currency, execution.execId, execution.orderId, execution.shares, execution.lastLiquidity)

@staticmethod

def BracketOrder(parentOrderId:int, action:str, quantity:float, limitPrice:float, takeProfitLimitPrice:float, stopLossPrice:float):

print('Bracket Order parentOrderId: {}'.format(parentOrderId))

#This will be our main or "parent" order

parent = Order()

parent.orderId = parentOrderId

parent.action = action

parent.orderType = "LMT"

parent.totalQuantity = quantity

parent.lmtPrice = limitPrice

#The parent and children orders will need this attribute set to False to prevent accidental executions.

#The LAST CHILD will have it set to True,

parent.transmit = False

takeProfit = Order()

takeProfit.orderId = parent.orderId + 1

takeProfit.action = "SELL" if action == "BUY" else "BUY"

takeProfit.orderType = "LMT"

takeProfit.totalQuantity = quantity

takeProfit.lmtPrice = takeProfitLimitPrice

takeProfit.parentId = parentOrderId

takeProfit.transmit = False

stopLoss = Order()

stopLoss.orderId = parent.orderId + 2

stopLoss.action = "SELL" if action == "BUY" else "BUY"

stopLoss.orderType = "STP"

#Stop trigger price

stopLoss.auxPrice = stopLossPrice

stopLoss.totalQuantity = quantity

stopLoss.parentId = parentOrderId

#In this case, the low side order will be the last child being sent. Therefore, it needs to set this attribute to True

#to activate all its predecessors

stopLoss.transmit = True

bracketOrder = [parent, takeProfit, stopLoss]

return bracketOrder

def main():

# Create the client and Connect to TWS API

client = TestBracketOrder('127.0.0.1', 7497, 7)

time.sleep(3)

client.orderId = None

# Define a Contract

contract = Contract()

contract.symbol = 'INFY'

contract.secType = 'STK'

contract.exchange = 'SMART'

contract.currency = 'INR'

contract.primaryExchange = "NSE"

# Request from TWS, the next valid ID for the order

client.reqIds(1)

time.sleep(3)

# Place a Bracket Order

if client.orderId:

bracket = TestBracketOrder.BracketOrder(client.orderId, "BUY", 100, 30, 40, 20)

for o in bracket:

client.placeOrder(o.orderId, contract, o)

time.sleep(3)

else:

print ('Order ID not received. Terminating Application')

sys.exit()

# Obtain information about open positions

client.reqPositions()

time.sleep(3)

# Disconnect from TWS

client.disconnect()

if __name__ == "__main__":

main()

Check out the Orders windows on TWS application and you should see a bracket order placed, with its corresponding profit taker and stop loss.

There are different kinds of Data that can be accessed viz the TWS API. That includes Financial News, Data required for Technical Analysis and Fundamental Analysis. Of interest to us is Live Market Data and Historical Data.

There are presently 4 functions to receive Market Data. The difference between these four actually lay in Delay between Updates, the number of simultaneous requests that each function can make and the Market Depth provided (Level 1 Data / Level 2 Data)

|

Function |

Data Details |

|

reqTickByTickData |

Tick-by-tick data corresponding to the data shown in the TWS Time & Sales Window |

|

reqMktData |

Requests real time market data |

|

reqRealTimeBars |

Real time and historical data functionality is combined through the IBApi.EClient.reqRealTimeBars request.

No more than 60 API queries in more than 600 seconds |

|

reqMarketDepth |

Requests the contract's market depth (order book). This request must be direct-routed to an exchange and not smart-routed |

Of primary interest to us is the reqMktData function which doesn't provide data as quickly as reqTickByTickData. The delay between updates depends on the type of contract and in Stocks it is generally about 250 milli seconds. Despite the small time delay, which I find acceptable to retail traders, the reqMktData function has multiple advantages over reqTickByTickData . Firstly you can request data for more contracts at a time and you can ask for more types of data with each request. The maximum number of requests is limited by the market data lines and the 50 messages per second limit.

reqMktData(reqid, contract, genericTickList, snapshot, regulatory, mktDataOptions)

The The TWS API provides six different callbacks for reqMktData. Each provides a different type of data, as explained in the below table:

|

tickPrice(reqId, field, price, attribs) |

Handles all price related ticks such as a security's ask price and bid price. Every tickPrice callback is followed by a tickSize. A tickPrice value of -1 or 0 followed by a tickSize of 0 indicates there is no data for this field currently available, whereas a tickPrice with a positive tickSize indicates an active quote of 0 (typically for a combo contract). |

|

tickSize(reqId, field, size)

|

Handles all size-related ticks such as a security's ask sizes, bid sizes, and volumes. |

|

tickString(reqId, field, value) |

This provides tick data that can be expressed as strings Every tickPrice is followed by a tickSize. There are also independent tickSize callbacks anytime the tickSize changes, and so there will be duplicate tickSize messages following a tickPrice. |

|

tickOptionComputation(reqId, field, impliedVolatility, delta, optPrice, pvDividend, gamma, vega, theta, undPrice)

|

Provides data and statistics related to options |

|

tickEFP(reqId, field, basisPoints, formattedBasisPoints, impliedFuture, holdDays, futureLastTradeDate, dividendImpact, dividendsToLastTradeDate)

|

Provides data for exhange-for-physical contracts |

|

tickGeneric(reqId, field, value) |

Provides generic tick data requested in reqMktData |

def tickPrice(self, reqId, field, price, attribs):

if field == 1:

self.bid_price = price

elif field == 2:

self.ask_price = price

elif field == 4:

self.last_price = price # Last price at which the contract traded

elif field == 6:

self.high_price = price

elif filed == 7:

self.low_price = price

elif field == 9:

self.close_price = price # The last available closing price for the previous day

reqRealTimeBars(reqId, contract, barSize, whatToShow, useRTH, realTimeBarsOptions)

reqRealTimeBars(id, contract, 5, 'ASK', True, [])The corresponding callback function for the above request is shown below:

realtimeBar(reqId: TickerId, time:int, open: float, high: float, low: float, close: float, volume: int, wap: float, count: int)

|

reqId |

the request's identifier |

|

Date |

the bar's date and time (Epoch/Unix time) |

|

Open |

the bar's open point |

|

High |

the bar's high point |

|

Low |

the bar's low point |

|

Close |

the bar's closing point |

|

Volume |

the bar's traded volume (only returned for TRADES data) |

|

WAP |

the bar's Weighted Average Price rounded to minimum increment (only available for TRADES). |

|

Count |

the number of trades during the bar's timespan ie; last 5 seconds (only available for TRADES) |

reqHistoricalData (int reqId, Contract contract, string endDateTime, string durationStr, string barSizeSetting, string whatToShow, int useRTH, int formatDate, bool keepUpToDate, List< TagValue > chartOptions )

|

reqId |

the request's identifier |

|

contract |

the contract for which we want to retrieve the data. |

|

endDateTime |

request's ending time with format yyyyMMdd HH:mm:ss {TMZ} |

|

durationStr |

the amount of time for which the data needs to be retrieved

|

|

barSizeSetting |

the size of the bar: 1 sec ,5 secs , 15 secs , 30 secs, 1 min, 2 mins, 3 mins, 5 mins, 15 mins, 30 mins, 1 hour, 1 day |

|

whatToShow |

the kind of information being retrieved: TRADES, MIDPOINT, BID, ASK, BID_ASK, HISTORICAL_VOLATILITY, OPTION_IMPLIED_VOLATILITY ,FEE_RATE, REBATE_RATE |

|

useRTH |

set to 0 to obtain the data which was also generated outside of the Regular Trading Hours, set to 1 to obtain only the RTH data |

|

formatDate |

set to 1 to obtain the bars' time as yyyyMMdd HH:mm:ss, set to 2 to obtain it like system time format in seconds |

|

keepUpToDate |

set to True to received continuous updates on most recent bar data. If True, and endDateTime cannot be specified. |

historicalData (int reqId, Bar bar )For The bar parameter in the above function is the OHLD historical bar.

reqHistoricalTicks (int reqId, Contract contract, string startDateTime, string endDateTime, int numberOfTicks, string whatToShow, int useRth, bool ignoreSize, ListmiscOptions)

|

reqId |

id of the request |

|

contract |

contract object that is subject of query |

|

startDateTime. |

"20170701 12:01:00". Uses TWS timezone specified at login. |

|

endDateTime |

"20170701 13:01:00". In TWS timezone. Exactly one of start time and end time has to be defined. |

|

numberOfTicks |

Number of distinct data points. Max currently 1000 per request. |

|

whatToShow |

(Bid_Ask, Midpoint, Trades) Type of data requested. |

|

useRth |

Data from regular trading hours (1), or all available hours (0) |

|

ignoreSize |

A filter only used when the source price is Bid_Ask |

|

miscOptions |

should be defined as null, reserved for internal use |

# Imports for the Program

from ibapi.client import EClient

from ibapi.wrapper import EWrapper

from ibapi.contract import Contract

from ibapi.order import Order

from ibapi.utils import iswrapper

import time

import threading

import datetime

import sys

class TestTradingData(EWrapper, EClient):

''' Serves as the Client and the Wrapper '''

def __init__(self, addr, port, client_id):

EWrapper.__init__(self)

EClient.__init__(self, self)

self.orderId = None

# Connect to TWS API

self.connect(addr, port, client_id)

# Launch the client thread

thread = threading.Thread(target=self.run)

thread.start()

@iswrapper

def nextValidId(self, orderId):

''' Provides the next order ID '''

self.orderId = orderId

# print('NextValidId: '.format(orderId))

print('The order id is: {}'.format(orderId))

@iswrapper

def tickByTickMidPoint(self, reqId, tick_timestamp, midpoint):

''' Callback to reqTickByTickData '''

print('\nThe Midpoint Tick from tickByTickMidPoint Callback: {}'.format(midpoint))

print('The timestamp of the realtime tick from tickByTickMidPoint: {}'.format(tick_timestamp))

@iswrapper

def tickPrice(self, reqId, field, price, attribs):

''' Callback to reqMktData '''

print('\nFrom tickPrice callback - field is: {}'.format(field))

if field == 1:

self.bid_price = price

print('Bid Price is: {}'.format(price))

elif field == 2:

self.ask_price = price

print('Ask Price is: {}'.format(price))

elif field == 4:

self.last_price = price # Last price at which the contract traded

print('Last Price is: {}'.format(price))

elif field == 6:

self.high_price = price

print ('High Price is: {}'.format(price))

elif field == 7:

self.low_price = price

print ('Low Price is: {}'.format(price))

elif field == 9:

self.close_price = price # The last available closing price for the previous day

print('Close Price is: {}'.format(price))

elif (field == 66 or field == 67 or field == 68 or field == 72 or field == 73 or field == 75): # Codes used for delayed data

self.delayed_price = price

print('Delayed Price is: {}'.format(price))

@iswrapper

def tickSize(self, reqId, field, size):

''' Callback to reqMktData '''

print('\nFrom tickSize callback - Requested field is: {} and Size is: {}'.format(field, size))

@iswrapper

def realtimeBar(self, reqId, bar_timestamp, open, high, low, close, volume, WAP, count):

''' Callback to reqMktData '''

print('\nOpen: {}, High: {}, Low: {}, Close: {} at Bar Timestamp: {}'.format(open, high, low, close, bar_timestamp))

@iswrapper

def historicalData(self, reqId, bar):

''' Callback to reqHistoricalData '''

print('\nOpen: {}, High: {}, Low: {}, Close: {}'.format(bar.open, bar.high, bar.low, bar.close))

@iswrapper

def error(self, reqId, code, msg):

print('Error Code: {}'.format(code))

print('Error Message: {}'.format(msg))

def main():

# Create the client and Connect to TWS API

client = TestTradingData('127.0.0.1', 7497, 7)

time.sleep(3) #Sleep interval to allow time for connection to server

client.orderId = None

# Define a Contract

# contract = Contract()

# contract.symbol = 'AAPL'

# contract.secType = 'STK'

# contract.exchange = 'SMART'

# contract.currency = 'USD'

contract = Contract()

contract.symbol = 'INFY'

contract.secType = 'STK'

contract.exchange = 'SMART'

contract.currency = 'INR'

contract.primaryExchange = "NSE"

# Define 10 Ticks containing midpoint data

client.reqTickByTickData(1, contract, 'MidPoint', 10, True)

# Request market data

client.reqMarketDataType(4) # Switch to live (1) frozen (2) delayed (3) delayed frozen (4).

client.reqMktData(2, contract, '', False, False, [])

# Request Real Time Bars of 5 seconds

client.reqRealTimeBars(3, contract, 5, 'MIDPOINT', False, [])

# Request Historical Bars

now = datetime.datetime.now().strftime("%Y%m%d, %H:%M:%S")

client.reqHistoricalData(4, contract, now, '2 D', '5 mins', 'BID', False, 1, False, [])

# Disconnect from TWS

time.sleep(10)

client.disconnect()

if __name__ == "__main__":

main()

Point to remember here is that if you are using the Free Trial version of IB, you may not have access to reqRealTimeBars and reqHistoricalData if you are using the Paper Trading Account. It may throw up errors messages like :

Error 354: Requested market data is not subscribed. Error 162: Historical Market Data Service error message: No market data permissions for NSE STK Error 10167: Requested market data is not subscribed. Displaying delayed market data...

Thanks for this wonderful blog. I am getting an error while running TestContract function where you use the reqMatchingSymbols function. The error is

ReplyDeletecontract.symbol = client.symbol

AttributeError: 'TestContract' object has no attribute 'symbol'

Could you please tell me why am I getting this error? Thanks

When the client calls reqMatchingSymbols, the corresponding callback function is symbolSamples. This is where we have initialized the self.symbol = contractDescriptions[0].contract.symbol. So the contract.symbol = client.symbol becomes an invalid attribute reference if the callback itself is not processed. Increasing the time.sleep() after calling the client.reqMatchingSymbols may help.

DeleteIdeally the script has to wait until the callback is processed. But using time.sleep() is good place to start with when we are focused on understanding the structure of TWS API.

In actual production , using time.sleep() is a very bad idea and needs to be done away with. So check out this post on thread synchronization: https://pavanmullapudy.blogspot.com/2020/09/thread-synchronization-using-event.html